The first three quarters of 2020 have seen pork imports of meat and offal soaring, as pork output in China has experienced falls for seven consecutive quarters and expectations for a swift recovery remain low. The latest data show a slight recovery in the third quarter of 2020, with a 18% increase in the YoY data, however this comparison is with an especially weak comparative quarter in 2019, when the output fell 42% YoY.

The official Agricultural Outlook 2020-2029 by the Ministry of Agriculture and Rural Affairs estimates that pork output will not be back to 2016-2018 levels until the end of 2022, although a steady recovery has started in the third quarter of 2020, the process will take time.

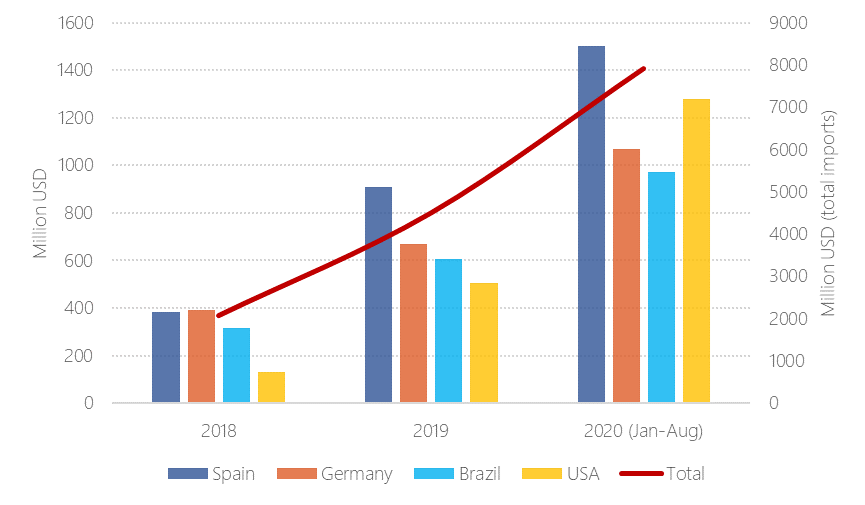

Pork imports already reached a record high in the first months of 2020, with over 7,900 million USD value only of meat products in the period from January to August, which is 75.84% higher than the entire year 2019. According to the USDA, pork imports are expected to reach 4.3 million tons in 2020, and stabilise from 2021 onwards.

Pork imports evolution (HS code 0203)

Source: Eibens with data from China’s General Administration of Customs

According to the Agricultural Outlook and State Council declarations on developing the livestock industry, China aims at 95% self-sufficiency in pork production after the herd recovery is complete. Although this means that imports will shrink compared to 2020 levels, taking into account that domestic consumption at 45 million tons in 2021 and expected to grow at a steady pace, 5% market share for imports indicates around 2-2.5 million tons of imported pork, a valuable share for exporters worldwide.

Import expectations in 2021 according to the USDA are at 3.7 million tons, which would mean a 14% decrease compared to 2020, but still 54% higher than those of 2019.

Overall, Chinese market expectations are very promising in the short term, and although volumes will decrease in the medium and long term, market situation will most likely continue to be favourable to exporters.