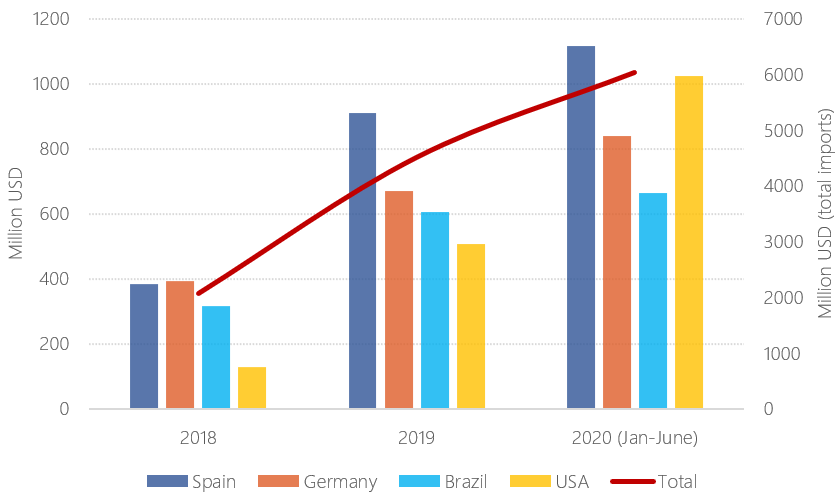

The first half of the year has been heavily disrupted by COVID-19, and the pork industry is not an exception. From January to June, China has seen pork imports skyrocketing, with a value 277% higher than the same period of 2019, and a 34% higher than the value of all pork imports in 2019.

Evolution of imports for code 0203 (2018-2020)

Source: Eibens with data from China’s General Administration of Customs

Source: Eibens with data from China’s General Administration of Customs

However, even if the pandemic initially benefitted pork exporters, after the June outbreak in Beijing, safety measures were tightened, and many pork producers were affected by import bans. The outbreak was linked to Xinfadi market in Beijing, and it was initially thought to come from imported salmon. Even if this claim was later refuted, tight custom controls and nucleic acid testing on imported products were implemented during the first weeks after the outbreak, causing delays and issues in different sectors. Between June 11th and June 17th, over 32,000 imported food samples were tested, although all tests resulted negative, some testing at arrival ports has continued since then, causing delays and logistic issues.

Starting on June 17th, just a few days after the Beijing outbreak was reported, different meat processing companies from all over the world started seeing their exports banned from entering China due to cases of COVID-19 among employees. 19 different pork processing plants from varying countries have seen their pork exports halted or have suspended them voluntarily, including companies in Germany, the UK, the Netherlands, Ireland, Italy, Brazil, Argentina, Spain and Denmark. By the beginning of August, only 2 of those 19 companies have had their export authorisations resumed.

Apart from the bans and testing in customs, other measures have been introduced in the past months to fight the virus. Since late June, exporters from 42 countries are asked to provide COVID-free official declaration, stating that they obey WHO recommendations and China’s food safety laws. International food safety authorities opposed these declarations because they imply that exporting companies have to comply with Chinese laws not specified in the declaration itself, and by doing so, the exporting companies are exposed to unknown legal consequences. Some countries, like the US, recommended their meat exporters not to sign the COVID-free declaration requested by China and create instead their own safety declarations.

Chinese authorities have also sent meat processing plants a set of guidelines for the prevention and control of COVID-19 epidemic and require that companies follow these guidelines. Although all tests carried out in June in imported food products were negative, there are still some delays at customs as control measures have increased and random testing still occurs. Exporting companies are obliged to test products at origin if there is a positive COVID-19 case among employees, and some countries, like Brazil, have suggested testing all meat products at origin to ease control measures in China and facilitate exports.

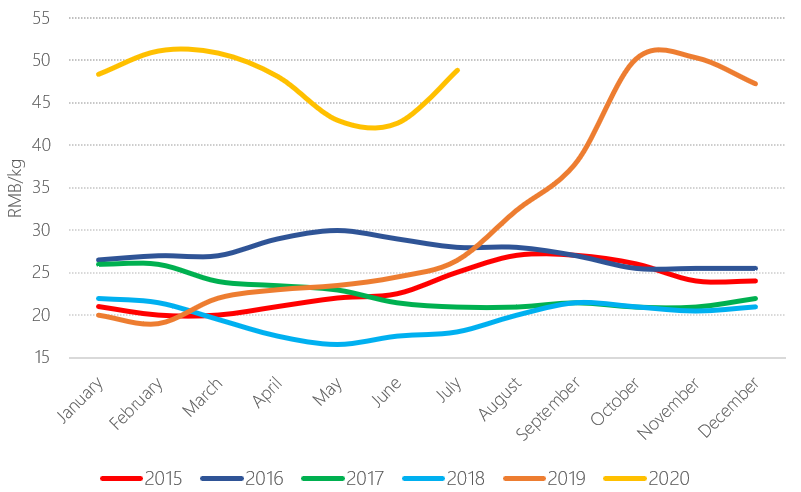

The pandemic has also had an impact on pork prices, first by lowering them as closures in US processing plants led to an increase of unprocessed pork exports with lower prices. Later due to different company restrictions and the reactivation of the economy after lockdown measures in China have increased pork demand and slightly reduced the availability of suppliers, rising the prices again. Given the uncertainty of outbreaks in the rest of the world, and possible measures that China might take, it is not expected that the price will fall significantly during the last 2 quarters of the year.

Moreover, other aspects such as trade tensions with the US, and cereal and price rising in the US and Brazil, together with tensions with other countries regarding different meat sectors, such as Australia, NZ or Canada, are affecting national pork prices and pushing them higher, benefitting foreign pork in the long run.

Evolution of pork prices in China (2018-2020)

Source: Eibens with data from China Swine