Since the outbreak that took place in June in a wholesale market in Beijing, Chinese authorities have turned their attention to frozen food imports, especially meat and seafood, in an attempt to eliminate the coronavirus threat from abroad after largely containing its initial outbreak.

Despite the guidance provided by international health authorities such as the European Food Safety Authority (EFSA), the World Health Organization (WHO) or the United States Centers for Disease Control and Prevention (CDC), that state that there is no evidence that food is a likely source or route of transmission of the virus, Chinese authorities have tested hundreds of thousands of imported food products, and have found traces of coronavirus in a few. According to Chinese media, some of these products have allegedly been linked to different positive cases across the country, while others just tested positive on arrival. These include shrimp from Ecuador, squid from Russia, fish from Norway and Indonesia, chicken wings from Brazil, beef and tripe from Brazil, Bolivia and New Zealand, as well as pork from Argentina, France and Germany. Some of these major food-producing countries have repeatedly requested the evidence for these findings, which has not been provided by Chinese authorities.

Overall, over 100 food companies across 20 countries have seen their exports halted following foreign factory workers contracting Covid-19 since June, including several pork processing plants.

Apart from the above-mentioned disruptions, the virus has affected a wide variety of aspects in the pork industry in China, creating supply and demand imbalances, affecting imports, prices and logistics.

In particular, the disruptions to the supply chain have been especially noticeable in the increasing prices of shipments and warehouse storage, specially from Europe to China.

Source: https://www.sse.net.cn/

Source: https://www.sse.net.cn/

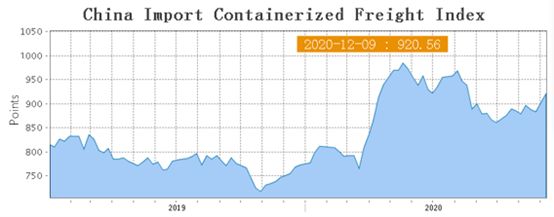

The emphasis on testing cold chain imports has created delays and increased prices in logistics. With an upward price trend as seen on the graphic above, the current disruptions have caused a bottleneck situation in ports and warehouses that will take some time to estabilize. Pork importers risk losing entire orders if the virus is found in any of the packaging, deterring or slowing down their actions in some cases.

The China Import Containerized Freight Index (CICFI) takes November 28, 2014 as the base period with the index of 1000 points, and analyses changes on price (USD/TEU) of the main world routes to China (Europe, Mediterranean, America E/C, America W/C, and Australia/New Zealand) to the 10 main ports in China: Dalian, Tianjin, Qingdao, Shanghai, Nanjing, Ningbo, Xiamen, Fuzhou, Shenzhen and Guangzhou. In the previous years, prices were relatively stable below the base index, but in 2020 all routes have seen a sharp increase in prices due to COVID-19 disruptions, being the Mediterranean route (Barcelona/Valencia/Genoa/Naples) and the European route (Hamburg/Rotterdam/Antwerp/Felixstowe/Le Havre) the most affected ones, currently at 1463 and 932 points respectively, well over American and Australian routes, which are below average index prices.

Although demand remains high, exporters face some difficulties and need to focus on safety and biosecurity in preparation for the new year ahead, as domestic prices stabilize, and Chinese consumers switch back to pork consumption from other alternative animal proteins consumed during 2020.