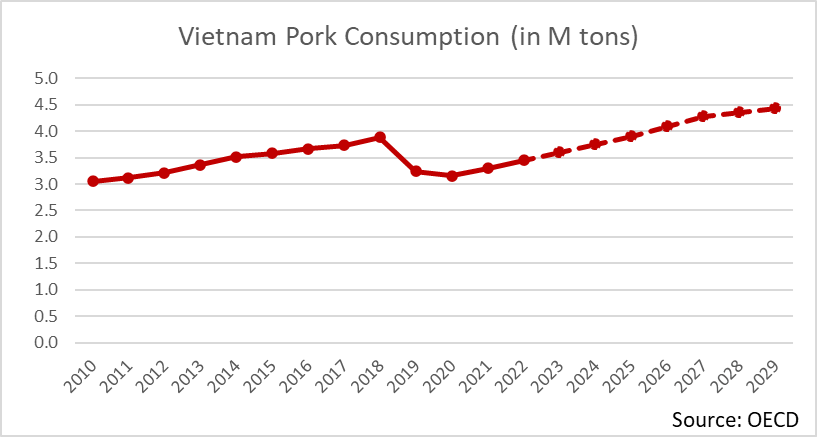

Vietnam’s pork consumption is swiftly rebounding from the African Swine Fever (ASF) crisis and is projected to sustain its growth trajectory. The surge in pork demand within the country can be attributed to several domestic factors: economic expansion, a growing and young population, increasing income levels, and a cultural preference for pork as a dietary staple.

The US Department of Commerce forecasts a 5% increase in Vietnam’s pork production, reaching 3.7 million tons by 2024, owing to the recovery of local demand [1]. Despite plans to scale up production, the industry still faces challenges with rising costs of production, particularly in animal feed and energy cost, and high interest rates.

These conditions create a fertile environment for exporters aiming to broaden their reach in Vietnam amidst growing consumption and steadily growing prices. Post-ASF, there is a heightened demand for quality pork. Vietnamese consumers are increasingly prioritizing food safety and quality, exhibiting a willingness to spend 20% more on pork over what is commonly available in traditional markets [2].

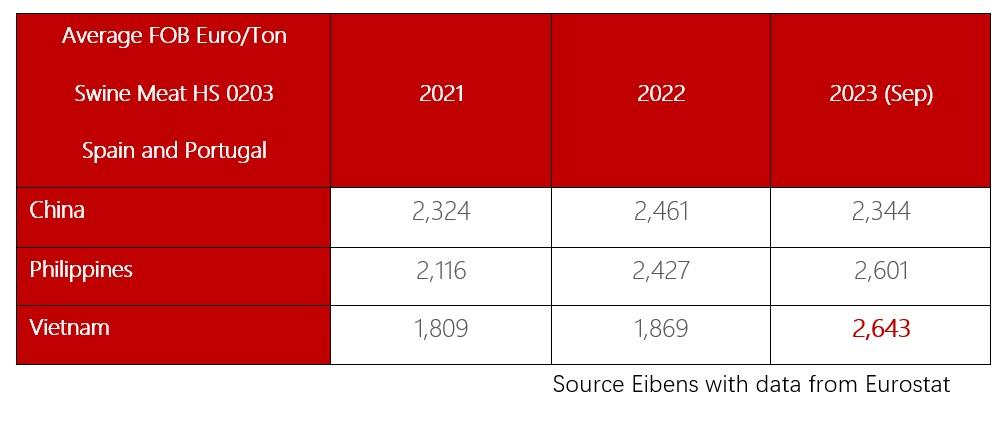

In the first 9 months of 2023, although Spanish (Portugal still gaining full market access) exports volume declined by -22% compared to last year, their exports value has increased by 21%. This was a result of a 32% increase in FOB prices. This resulted in Vietnam becoming having the highest FOB price compared to China and Philippines [3].

[1] Vietnam’s pork output to increase by 5% in 2024 – AsianAgribiz (www.asian-agribiz.com)

[1] Vietnam’s pork output to increase by 5% in 2024 – AsianAgribiz (www.asian-agribiz.com)

[2] Investing in upgraded pork offers opportunity to improve food safety and incomes in Vietnam – ILRI (www.ilri.org)

[3] Eurostat (ec.europa.eu)