During the first five months of this year, China experienced a relevant increase in pork imports, witnessing a 15% increase in quantity. This growth stands in stark contrast to the 35% surge in pork imports by value during the same period. The driving force behind this disparity is a notable 18% increase in the price per kilogram, as compared to the first five months of 2022.

Interestingly, only two-thirds of the price increase per imported kilogram can be attributed to an uplift in prices imposed by the country’s suppliers. The remaining one-third can be traced back to a clear depreciation of the Chinese yuan against other currencies. It is worth noting that this depreciation is being actively managed by China’s central bank and is anticipated to persist in the foreseeable future.

Total pork imports went up to 1268 thousand tons from 1102 thousand tons a year earlier. As for the value, imports during the first five months reached US$3,170 million from US$2,350 million in 2022.

To emphasize that the average CIF price per kilogram of imported pork stands at 17-yuan while the domestic price for early June hovers around 14 yuan per kilogram. In June month, according to price portals[1] the expectations for domestic pork indicate sufficient pork stocks and to some extent an oversupply of pork. As a result, pig prices in June lack a solid foundation for a significant increase.[2]

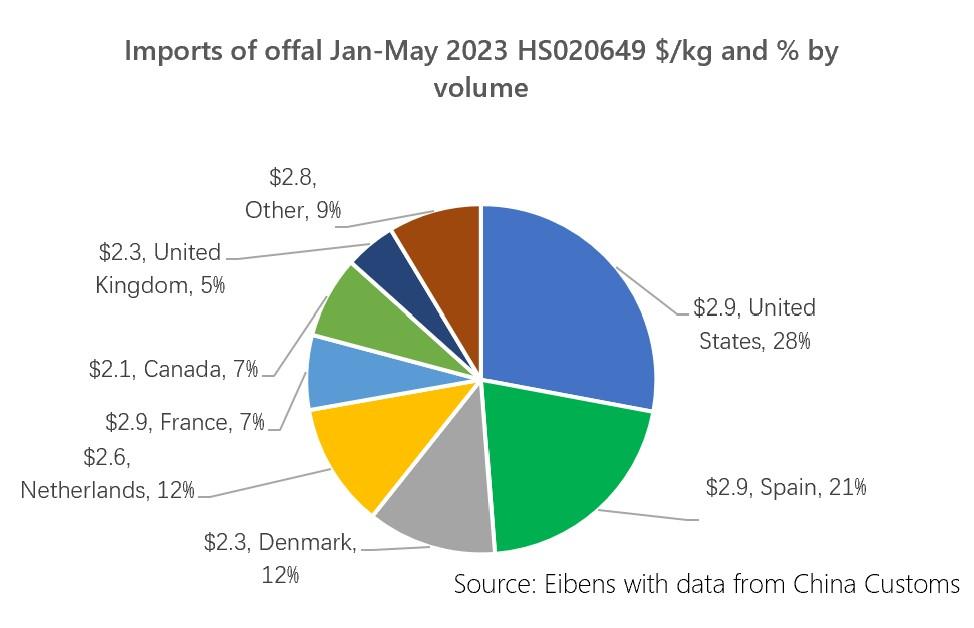

Swine meat imports grow 19% in volume and 43% in value. As for edible offal, the growth in volume is 9% while in value is of 24%.

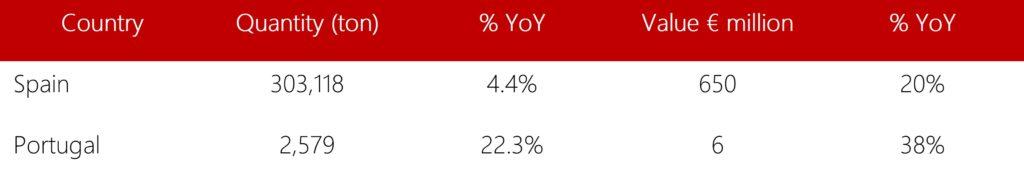

As for Spain, and Portugal, the data shows the following:

As for Spain, and Portugal, the data shows the following:

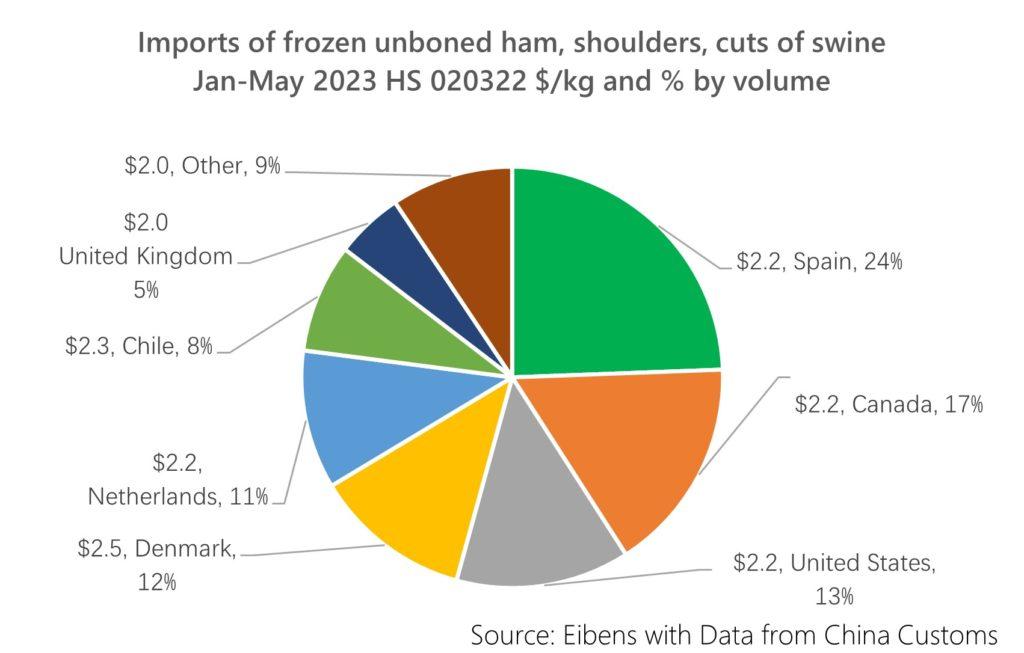

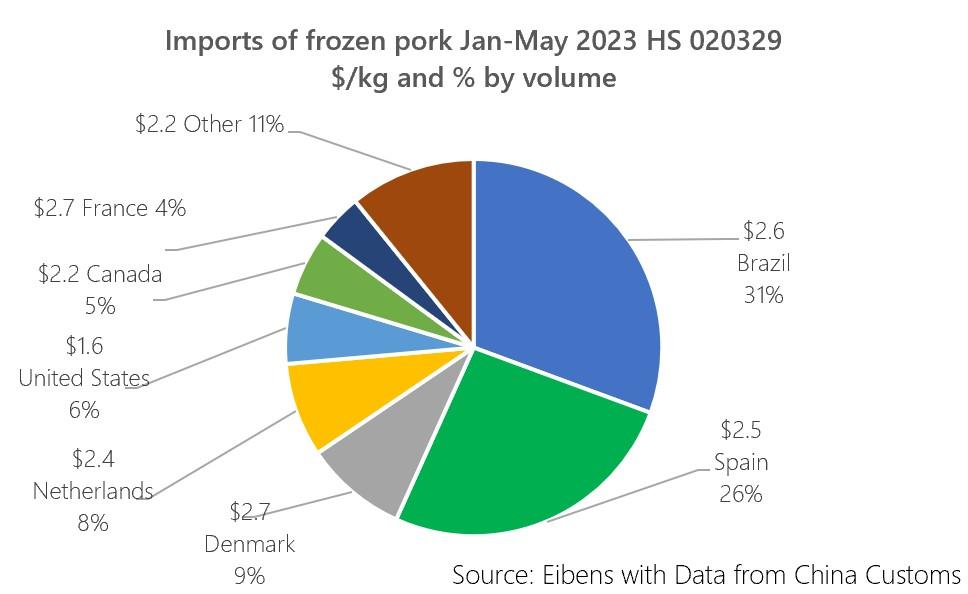

To ascertain the positive and negative aspects, refer to the following table that compares the growth of imports in volume per tariff code of China as a whole and its imports from Spain and Portugal. This analysis will shed light on both the favourable and unfavourable sides. It summarizes imports of the first five months of 2023 for China, and the two European Union countries.

To ascertain the positive and negative aspects, refer to the following table that compares the growth of imports in volume per tariff code of China as a whole and its imports from Spain and Portugal. This analysis will shed light on both the favourable and unfavourable sides. It summarizes imports of the first five months of 2023 for China, and the two European Union countries.

The five-month series is still relatively short to draw definitive conclusions. One speculation could be that a portion of imports from Spain might have been redirected to Denmark and the Netherlands, while another possibility is that some offal supply has been redirected to the United States. However, it would be premature to make firm judgments until having in hand data for the whole semester.

Looking ahead to the remainder of the year, the outlook appears positive. However, there are two important considerations to keep in mind. The primary concern is the apparent reluctance of households to augment their expenditures, despite the overall inflation remaining stable. In the first five months, the consumer price index experienced a modest year-on-year increase of 0.8 percent, while pork prices decreased [3] by 3.2% in May. The second caveat that could impact pork imports from the European Union relates to the yuan exchange rate. Since January 1st, the yuan has depreciated [4] by 6% against the EUR.

[1] www.dxumu.com

[2] According to analyst Doris Zhang “industry insiders believe the current supply of live pigs and pork is still high, but at the same time, the demand is insufficient. That is the main reason for the current persistent low pig prices”.

[3] National Economy Continued to Recover in May (stats.gov.cn)

[4] Chinese yuan renminbi (CNY) (europa.eu)