Pork production and imports are expected to rise (and are already doing so) as it usually happens for this last period of the year. The truth is that retail is maintaining its price level despite the higher demand and the pressure from the imported market. For example, liempo (pork belly) is around 363.43 PHP/Kg (5.89 euros) almost the same as the 361.45 PHP/Kg (5.86 euros) [1] noted last September. Domestic production is showing some recovery, nevertheless, the capacity isn’t ready to assimilate all of the demand during these months, and distributors get ready for peak season by buying a lot of imported cuts.

The Filipino swine imported market is ending differently than how it’s been behaving throughout the year. Although since October the country was indeed the top 1 destination of Brazilian pork, there are some indicators to be highlighted. Prices of live pigs in North and South America have been increasing fast lately (especially in Brazil). In concrete, according to data from Mercolleida, a comparison between 2023 and 2024 makes it (including offal and meat) +30% for the USA and +45% for Brazil [2]. This increase in live carcasses may have an impact soon. That’s what is already happening with Canada, which is one of the major players. The large reliance on exports and a domestic supply that was lower than expected can be one of the main reasons for this upward trend in American markets.

This is good news for EU producers as the price difference is in general getting narrower. Excepting China, Asian countries keep importing more pork to cover demand, and price was until now the key advantage for America vs Europe.

In contrast, Spain and other EU production looks consistent and quantities exported to the Filipino market are forecasted to grow. Supply finishes the year in high, as well as pig weights (in October, the average price of 20kg whole pig carcass was 46 EUR, while the same week in 2023 was 64 EUR). The industry is recovering and coming back to where it was in 2022. Furthermore, the EU and the Philippines agreed in March to resume negotiations for more bilateral and free trade agreements, after some past tensions regarding animal diseases. Both countries focus on sustainability and the high quality of the meat provided by Europe.

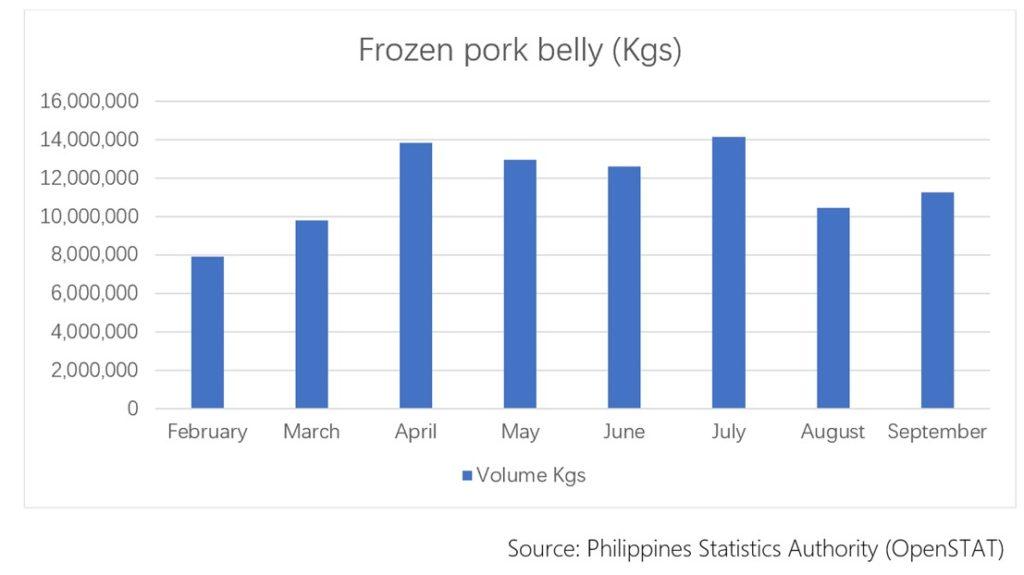

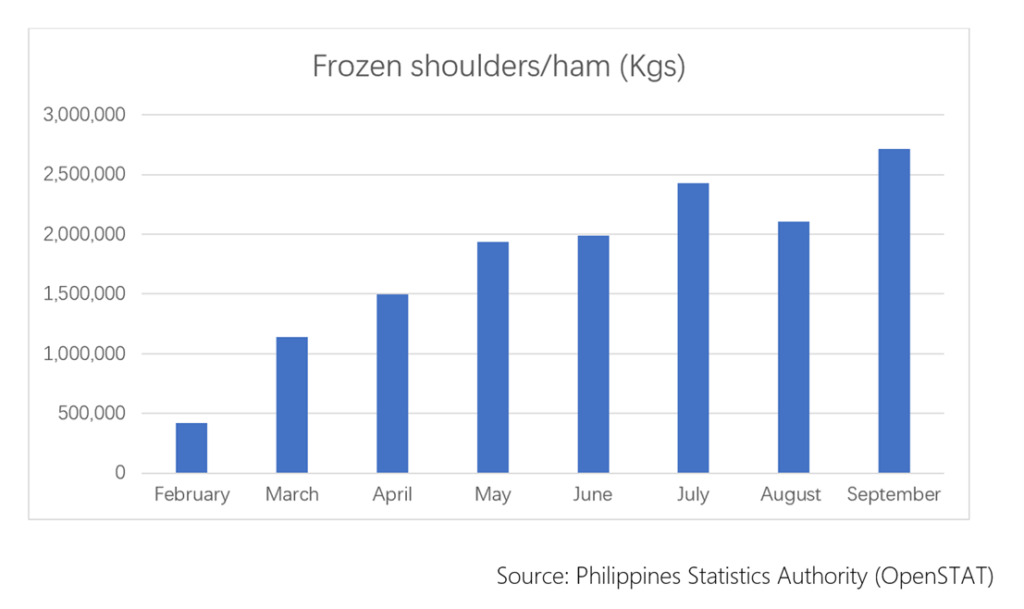

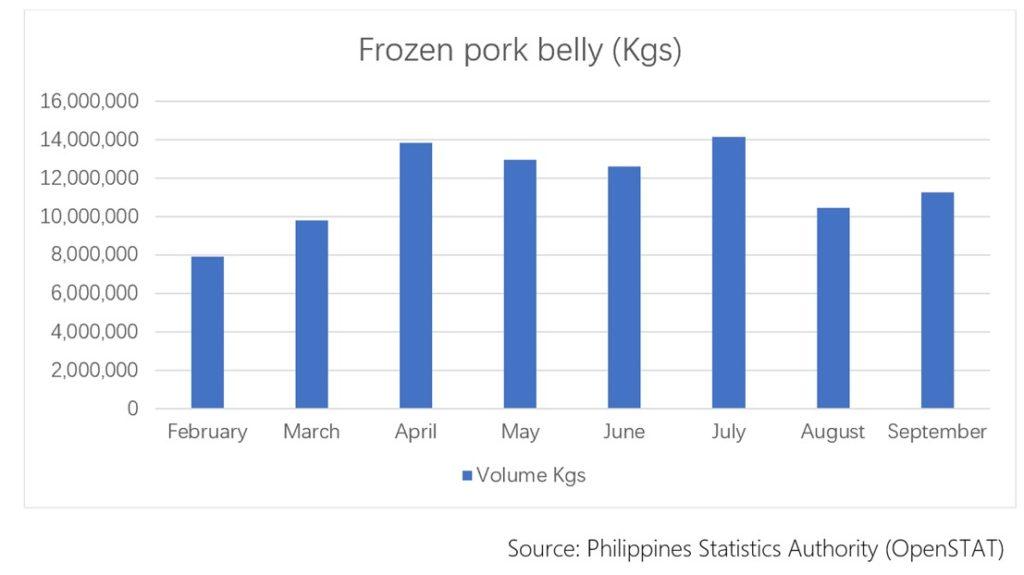

On another note, looking back at 2024, these were the top commodities imported in The Philippines: Frozen belly (HS 020329) and pork shoulders or ham (HS 020322).

Ham and shoulder imports have been rising since the beginning of the year (last data from September). Canada, Brazil, Spain, and other EU markets are major players. Canada is first but Brazil’s price looks slightly more competitive at a rate of 0.72 EUR/Kg and it’s the showing a strong upward trend since January (although the prices of pigs should slow it down).

Pork belly shows less growth but still is by far the most imported commodity as it is very convenient for many Filipino dishes and food products. Spain and Brazil share the leadership. Brazil has been increasing its market share since its political agreement mid-time this year. 2.9 million Kg of Brazilian pork belly arrived in September vs 1.6 million from Spain. The cheap price of 0.48 USD/Kg vs the 0.72 for Spain may be the answer to that.

Pork belly shows less growth but still is by far the most imported commodity as it is very convenient for many Filipino dishes and food products. Spain and Brazil share the leadership. Brazil has been increasing its market share since its political agreement mid-time this year. 2.9 million Kg of Brazilian pork belly arrived in September vs 1.6 million from Spain. The cheap price of 0.48 USD/Kg vs the 0.72 for Spain may be the answer to that.

[1] https://www.da.gov.ph/price-monitoring/

[2] Boletín Mercolleida n 2864 https://www.mercolleida.com/