Pork demand and consumption are increasing in Vietnam, and it’s expected to be sustained. According to the US Department of Agriculture, pork consumption in Vietnam will go up by 28.3% in 2030 compared to 2023. It is one of the markets with stronger growth in consumption for the next years marking the highest in Asia at 38.2 kg [1].

This, in return, is reshaping the Vietnamese pork industry. As demand increases, sector professionals are trying to benefit from the situation, but their production infrastructure is unable to cover the increasing demand. Accordingly, many key players like Dabaco, BAF Vietnam, THACO Agri, and many others are deciding to invest in re-herding and improving their productivity (construction, production complexes) to be able to profit and take advantage of how the market scenario projects.

For example, THACO Agri states they are planning on developing a pig herd of around 136,000 heads, but Dabaco also says [2] that it will take them at least 18 months to overcome the supply shortage.

Nevertheless, as supply is currently not reaching the demand, prices are rising.

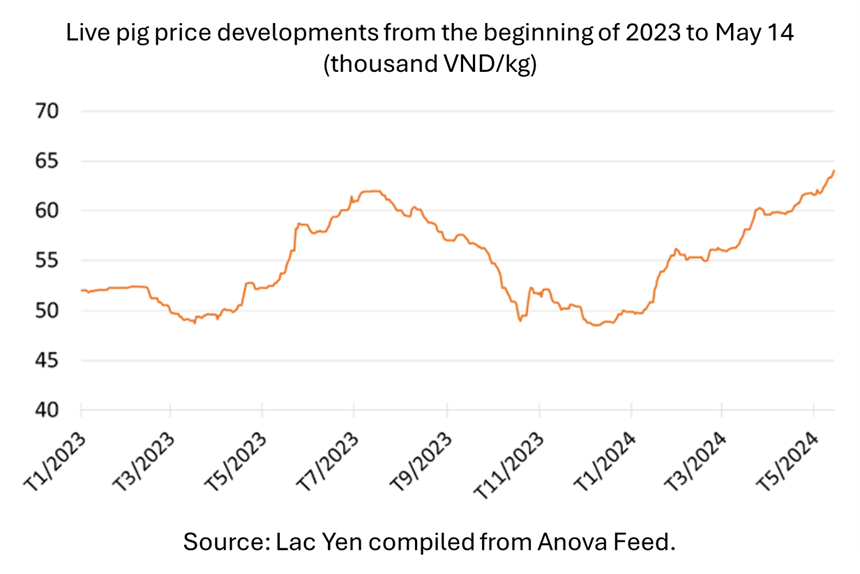

Pig price level has increased from 50,000 VND/kg (1.80 EUR/kg) at the beginning of the year to around 65,000 VND/kg [3] (2.34 EUR/kg). As seen in the graph above, same trend happened last year, but not reaching as high as this year. The first quarter of 2024 was 5,000 VND/kg (0.18 EUR/kg) higher (+9.7%) than the same period last year [4]. With livestock companies working for their re-herding, supply should stay limited, and prices are not expected to decrease.

Pig price level has increased from 50,000 VND/kg (1.80 EUR/kg) at the beginning of the year to around 65,000 VND/kg [3] (2.34 EUR/kg). As seen in the graph above, same trend happened last year, but not reaching as high as this year. The first quarter of 2024 was 5,000 VND/kg (0.18 EUR/kg) higher (+9.7%) than the same period last year [4]. With livestock companies working for their re-herding, supply should stay limited, and prices are not expected to decrease.

It is a great opportunity for other markets to fill this gap and position vs domestic players. Although feed prices are decreasing [5], supply is still short and large quantities of pork are imported to cover the demand [6].

In the EU, in Spain for example, Mercolleida prices closed in April at 1.80EUR/kg live [7], -10% compared to the same period last year. The price of raw materials is decreasing and, consequently, the production cost of pigs is decreasing. Therefore, the EU can leverage high quality and reduced production costs to gain more share in the growing Vietnamese imports market.

[1] Vietnam’s pork consumption will increase by nearly 30% by 2030 (nongnghiep.vn)

[2] https://vietnambiz.vn/dabaco-baf-hagl-do-xo-tai-dan-khi-heo-tang-gia-202451410425304.htm

[3] https://nhachannuoi.vn/thaco-agri-nam-2024-se-phat-trien-dan-heo-tren-136-000-con-dan-bo-tren-150-000-con/

[5] https://nhachannuoi.vn/gia-thuc-an-chan-nuoi-giam-lan-thu-2-trong-nam-2024/

[6] Thịt lợn nhập khẩu đổ về Việt Nam, giá chỉ 55.000 đồng/kg (vietnamnet.vn)

[7] Pig price in Spain – Mercolleida – Live – pig333, pig to pork community