The pork market has been in recovery mode in the last few months driven by less supply and stable demand that led to increasing prices. Aside from a slight decline at the end of August, the price trend has been going up continuously for both local and imported pork. Imports volume has been going up with increasing prices, and Russia appears as a new player.

After a long time of oversupply led by liquidations over financial losses, pork stocks at the end of the second quarter of 2024 decreased by -4.6% YOY, and pork production in the first half decreased by -1.7% YOY [1]. The supply has been declining throughout the year, reaching the lowest point in August until the end of the month when it slightly increased again.

This can be seen reflected in the price, which reached its maximum in mid-August and slightly decreased towards the end as shown in the chart below.

The price increase was seen in both fresh meat and frozen pork but with faster increases in fresh pork prices. In terms of frozen storage capacity, there is a weekly decline rate of 1.7%, reaching an inventory level of 20% by August [2] compared to 30% same period last year.

The increase in the prices of some imported pork products is significant since late May. In July the average price of imported pork was about 13,965 yuan/ton (1,780 EUR/ton), +9% from the previous month. Some cuts have increased in price including ribs, front and hind leg meat, spine (meat and bones), among others [3].

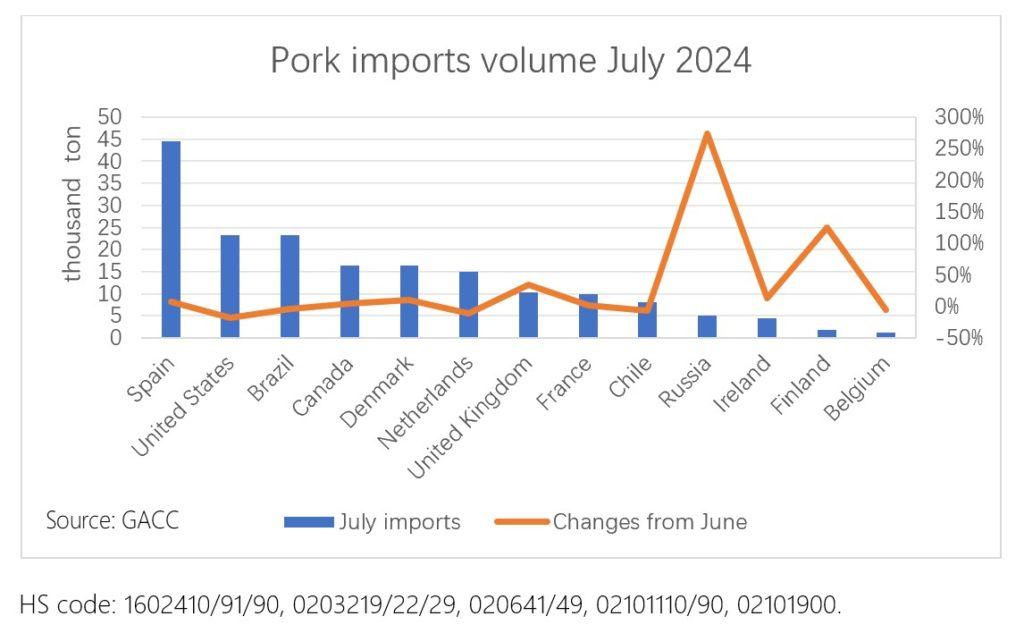

There has been no significant change in the volume of meat imports after the Anti-dumping investigation was released this past July. In fact, in that month, China imported 190 thousand tons of pork and offal, a significant increase from June with meat volume increased by 3.8%, while the offal increased by 2.6%. Spain remains the leading exporter to China and increased 8% in volume. United States, Brazil, Chile, Netherlands, and Belgium declined in volume.

HS code: 1602410/91/90, 0203219/22/29, 020641/49, 02101110/90, 02101900.

Russia is expanding quickly since the ban was lifted with 3 times the volume of June. In 2024 Russia began exporting to China in April. By July, Russian companies had supplied 4,735 tons of pork to China (total trade value of USD 12 million/ EUR 11 million), which could increase to at least 15,000 tons by the end of the year [4], equivalent to 1% of China’s total imports in 2023.

Overall, Chinese pork market is showing recovery signs with opportunities for both local and imported products to expand together.

[1] 俄罗斯首次进入中国前五大猪肉供应国之列 https://mp.weixin.qq.com/s/rG6O5PaV61K7qrr7aiv5DQ

[2] 跌了,猪价“跌翻天”!附:8月18日猪价行情_腾讯新闻 (qq.com)

[3] 猪肉 | 进口猪肉看涨预期拉动,7月进口产品价格延续上行走势_生猪及猪肉_畜牧_中国饲料工业信息网 (chinafeed.com.cn)