The global trade landscape has seen a dynamic start to the year. Among all the movements and fluctuations that are taking place, pork is one of the major protagonists. In the United States, new policies aimed at revitalising domestic industries have included import tariffs, such as a 10% rate on Chinese goods and additional measures affecting regional trade partners like Canada and Mexico [1]. By March, further tariffs targeting shipping from China were announced, prompting China to introduce its own set of import duties. These include 15% tariffs on key agri-food products such as chicken, corn, and cotton, and 10% on pork, beef, and soybeans [2]. In addition, a 34% tariff on all products from the United States was imposed [3]. However, the situation continues to fluctuate.

Last year, China imported 408,000 tons of pork from the U.S. [4], accounting for 17% of its total imports. At the Annual Assembly in early March, Chinese authorities discussed the possibility of diversifying international trade relations to ensure market stability and food security.

Domestically, expectations of growing pork demand in China in 2023 did not materialise, leading to overproduction and pressure on margins. Many smaller producers exited the market. To address this, the government introduced measures to reduce the supply and restore balance. Combined with high beef prices, these efforts have contributed to improved profitability for local farmers in recent months [5].

Despite signs of recovery, farmers remain cautious about rapidly increasing production. Concerns about a return to oversupply and the effects of recent herd control measures suggest that overall availability of pork for consumption could decline. As a result, China—still the world’s largest consumer of pork—may turn to greater imports to supplement its strategic reserves.

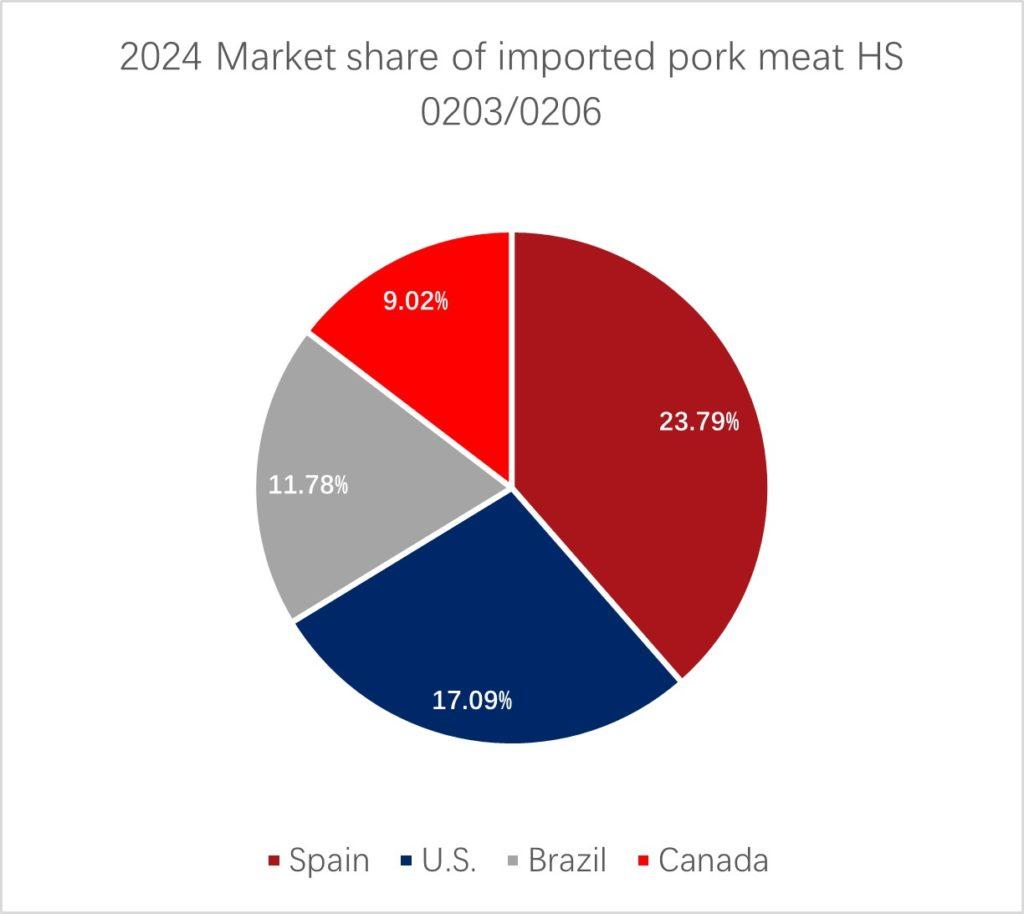

The U.S., which held a 17% share of China’s pork imports in 2024, may see its position shift in light of recent changes. Brazil remains a key supplier, but rising feed costs and limitations on offal exports could affect its competitiveness [6].

The European Union, which provides nearly half of China’s imported pork, is in a favourable position to expand its market share. While the EU had lost some ground in recent years, current pricing is competitive once again. As of mid-January, the Ministry of Agriculture and Rural Affairs reported that the average live pig price in China stood at €2.21/kg, with piglet prices at around €79 for 18 kg.

Source: China customs (GACC)

In comparison, average prices in Spain were €1.50/kg for live pigs and €75 for 20 kg piglets, according to Mercolleida. Portugal reported similar figures, with live pigs priced at €2.21/kg, according to Bolsa Do Porco. Stable pricing and rising total weights in EU markets suggest solid capacity for exports, potentially supporting greater volumes to China.

[1] USTR Seeks Public Comment on Proposed Action in Section 301 Investigation of China’s Targeting of the Maritime, Logistics, and Shipbuilding Sectors

[2] Trump tariffs China reacts,

[3] China to impose additional 34% tariffs on all U.S. imports

[4] 重磅!中国对美国猪肉加征10%关税,欧盟启动反倾销调查,全球猪肉贸易战一触即发? – 养猪新闻 – 中国养猪网-中国养猪行业门户网站

[5] Its back to normal for China’s pig industry

[6] Perspectivas Para China 2025 Inventario-Consumo Y Comercio Porcinos