The prevailing consensus among external observers [1] suggests that China will likely need to increase its pork imports, despite the month-on-month decline. By value, swine meat imports increased by 27% from January to August compared with the same period last year.

The decrease in month-on-month imports is attributed [2] to the narrowing price gap between imported and domestic pork. However, analysts express confidence that as domestic pork prices rebound and suppliers in other countries soften their prices for exports to China, the nation will likely resume its trend of increasing swine meat imports.

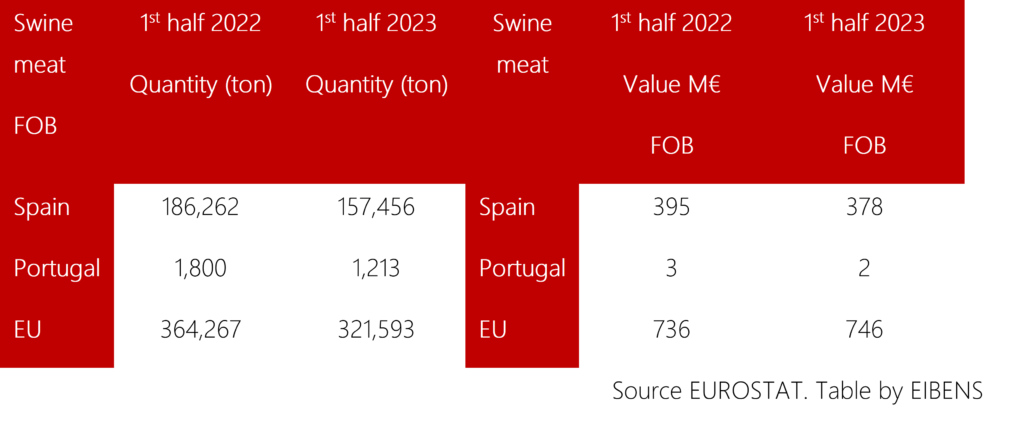

The EU exports of swine meat by volume to China in the first half of 2023 experienced a drop of -12% while there was a 1% increase in value. Spain and Portugal experienced a drop in volume respectively as compared to the same period of last year of -15% (Spain) and -33% (Portugal).

The drop in volume of exports from the EU to China follows a current increase in price per kilogram. This price increase is consistent across EU swine meat exporters, with the EU experiencing a 15% price hike, while Spain saw a 13% increase and Portugal recorded a 17% rise. This resulted in a drop in volume of -27% for the exports of EU swine meat to China.

As for offal, there´s a drop of imports by volume of 3% from the EU caused by a decrease of 22% from Denmark while the rest of EU stayed flat or increased its offal exports. Regarding the two participants in the campaign, China increased its offal imports by volume from Portugal 21% while the increase from Spain was of 1%, although the latter comes from a much larger base.

As for offal, there´s a drop of imports by volume of 3% from the EU caused by a decrease of 22% from Denmark while the rest of EU stayed flat or increased its offal exports. Regarding the two participants in the campaign, China increased its offal imports by volume from Portugal 21% while the increase from Spain was of 1%, although the latter comes from a much larger base.

[1] Genesus Global Market Report (envoke.com)

[2] Viewpoint | Hogs can still be expected in the future Market or delayed and highly restricted _ Oriental Wealth Network (eastmoney.com)

[…] clindamicina 150mg capsules[…]

clindamicina 150mg capsules

does fluoxetine give you energy

does fluoxetine give you energy

what happens when you stop taking zoloft

what happens when you stop taking zoloft

mma metronidazole

mma metronidazole

taking cymbalta while pregnant

taking cymbalta while pregnant

can dogs take keflex for ear infection

can dogs take keflex for ear infection

difference between dog and human cephalexin

difference between dog and human cephalexin

bupropion gabapentin

bupropion gabapentin

does lexapro make you lose weight

does lexapro make you lose weight

generic viagra in us

generic viagra in us

how to prenounce escitalopram

how to prenounce escitalopram

cymbalta (duloxetine)

cymbalta (duloxetine)

cephalexin capsules

cephalexin capsules

allergic reaction to ciprofloxacin hcl

allergic reaction to ciprofloxacin hcl

bactrim dosing for uti uptodate

bactrim dosing for uti uptodate

how long does bactrim stay in your system after the last pill

how long does bactrim stay in your system after the last pill

amoxicillin 875 mg

amoxicillin 875 mg

neurontin tablet strength

neurontin tablet strength

augmentin 875 mg

augmentin 875 mg

diclofenac sodium topical gel 1 reviews

diclofenac sodium topical gel 1 reviews

mylan ezetimibe

mylan ezetimibe

hydrochlorothiazide and flomax

hydrochlorothiazide and flomax

ddavp in liver failure

ddavp in liver failure

brand name for citalopram

brand name for citalopram

cozaar price

cozaar price

depakote er 500mg

depakote er 500mg

verapamil vs diltiazem

verapamil vs diltiazem

vitamin d and contrave

vitamin d and contrave

flexeril overdose

flexeril overdose

effexor xr withdrawal

effexor xr withdrawal

aripiprazole moa

aripiprazole moa

allopurinol 100mg side effects

allopurinol 100mg side effects

amitriptyline for dogs

amitriptyline for dogs

aspirin nsaid

aspirin nsaid

augmentin is in which class of drugs

augmentin is in which class of drugs

bupropion hcl sr 150 mg

bupropion hcl sr 150 mg

ashwagandha while breastfeeding

ashwagandha while breastfeeding

celecoxib 200 mg used for

celecoxib 200 mg used for

robaxin vs baclofen

robaxin vs baclofen

protonix rob holland

protonix rob holland

pharmacodynamie actos

pharmacodynamie actos

repaglinide category

repaglinide category

constipation on semaglutide

constipation on semaglutide

robaxin generic name

robaxin generic name

remeron versus effexor

remeron versus effexor

abilify and tardive dyskinesia

abilify and tardive dyskinesia

acarbose liver

acarbose liver

sitagliptin 50 mg uses

sitagliptin 50 mg uses

how long does it take for tizanidine to work

how long does it take for tizanidine to work

ivermectin generic

ivermectin generic

how much potassium in spironolactone

how much potassium in spironolactone

tamsulosin hcl 0.4 mg cap side effects

tamsulosin hcl 0.4 mg cap side effects

synthroid nodules

synthroid nodules

pristiq vs venlafaxine

pristiq vs venlafaxine

voltaren gel 1% walmart

voltaren gel 1% walmart

cialis online pills

cialis online pills

is 60 mg of sildenafil too much

is 60 mg of sildenafil too much

buy levitra

buy levitra

levitra online medicine

levitra online medicine

overnight pharmacy tramadol

overnight pharmacy tramadol

how much does cialis cost at the pharmacy

how much does cialis cost at the pharmacy

goodrx sildenafil reviews

goodrx sildenafil reviews

cheapest cialis tadalafil 20 mg

cheapest cialis tadalafil 20 mg

tadalafil e20 pill

tadalafil e20 pill

best liquid tadalafil 2018

best liquid tadalafil 2018

vardenafil pulmonary hypertension

vardenafil pulmonary hypertension

stromectol ivermectin 3 mg

stromectol ivermectin 3 mg

auvitra vardenafil tablets

auvitra vardenafil tablets

buy viagra pills canada

buy viagra pills canada

stromectol covid 19

stromectol covid 19

cost of ivermectin pill

cost of ivermectin pill

cost of ivermectin cream

cost of ivermectin cream

ivermectin 6 tablet

ivermectin 6 tablet

30 mg sildenafil chewable

30 mg sildenafil chewable

stromectol ivermectin buy

stromectol ivermectin buy

gabapentin for dogs: dosage

gabapentin for dogs: dosage

will metronidazole treat uti

will metronidazole treat uti

keflex allergy

keflex allergy

how long does it take for trazodone to work

how long does it take for trazodone to work

side effects from lisinopril

side effects from lisinopril

is tamoxifen a chemo drug

is tamoxifen a chemo drug

can you take benadryl with prednisone

can you take benadryl with prednisone

valacyclovir dosage for cold sore

valacyclovir dosage for cold sore

does cephalexin treat gonorrhea and chlamydia

does cephalexin treat gonorrhea and chlamydia

ciprofloxacin and alcohol affect

ciprofloxacin and alcohol affect

can lyrica cause weight gain

can lyrica cause weight gain

provigil pros cons

provigil pros cons

doxycycline for syphilis

doxycycline for syphilis

amoxicillin during pregnancy

amoxicillin during pregnancy

can i take an extra metformin if my sugar is high

can i take an extra metformin if my sugar is high

tamoxifen online

tamoxifen online

levitra now online

levitra now online

pharmacy online

pharmacy online

vardenafil 20mg online

vardenafil 20mg online

can you take tadalafil and sildenafil together

can you take tadalafil and sildenafil together

female viagra pill

female viagra pill

how often can you take sildenafil

how often can you take sildenafil

how long does 100 mg sildenafil last

how long does 100 mg sildenafil last

sildenafil citrate 100mg tab

sildenafil citrate 100mg tab

sildenafil 50

sildenafil 50

sildenafil alcohol

sildenafil alcohol

buying generic levitra online

buying generic levitra online

how long does cialis last

how long does cialis last

plavix pharmacy assistance

plavix pharmacy assistance

levitra without prescription

levitra without prescription

what is tadalafil generic for

what is tadalafil generic for

viagra vs levitra

viagra vs levitra

will tadalafil lower blood pressure

will tadalafil lower blood pressure

cialis tesco pharmacy

cialis tesco pharmacy

sildenafil 50mg tablets

sildenafil 50mg tablets

levitra 40 mg reviews

levitra 40 mg reviews

indocin online pharmacy

indocin online pharmacy

reputable online pharmacy no prescription

reputable online pharmacy no prescription

sildenafil 50 mg price at walmart

sildenafil 50 mg price at walmart

cialis heart benefits

cialis heart benefits

proscar inhouse pharmacy

proscar inhouse pharmacy

sildenafil 20 mg not working

sildenafil 20 mg not working

vardenafil for stamina reddit

vardenafil for stamina reddit

tadalafil lower blood pressure

tadalafil lower blood pressure

viagra prices pharmacy

viagra prices pharmacy

bay rx pharmacy

bay rx pharmacy

what happens if a woman takes tadalafil

what happens if a woman takes tadalafil

pakistan pharmacy valium

pakistan pharmacy valium

celebrex pharmacy coupon

celebrex pharmacy coupon

tadalafil 5mg daily

tadalafil 5mg daily

ed drug vardenafil levitra

ed drug vardenafil levitra

tadalafil and grapefruit

tadalafil and grapefruit

anthem online pharmacy

anthem online pharmacy

can you take mucinex with ibuprofen

can you take mucinex with ibuprofen

do you have to take celebrex with food

do you have to take celebrex with food

celecoxib fiebre

celecoxib fiebre

alcohol and sulfasalazine

alcohol and sulfasalazine

neurontin off label uses

neurontin off label uses

carbamazepine effects and side effects

carbamazepine effects and side effects

can i take motrin with acyclovir

can i take motrin with acyclovir

gabapentin mushrooms

gabapentin mushrooms

tegretol dolore neuropatico

tegretol dolore neuropatico

etodolac pi

etodolac pi

can imitrex cause high blood pressure

can imitrex cause high blood pressure

where can i buy generic pyridostigmine pills

where can i buy generic pyridostigmine pills

mestinon alcohol interaction

mestinon alcohol interaction

elavil detox

elavil detox

diclofenac 1%

diclofenac 1%

indomethacin oxycodone

indomethacin oxycodone

amitriptyline anxiety

amitriptyline anxiety

long term use of mebeverine hydrochloride

long term use of mebeverine hydrochloride

cilostazol tab 100mg

cilostazol tab 100mg

purchase sumatriptan online

purchase sumatriptan online

donde comprar lioresal

donde comprar lioresal

imdur 30mg tablet

imdur 30mg tablet

rizatriptan benzoate polymorphism

rizatriptan benzoate polymorphism

order mobic

order mobic

imuran and eye problems

imuran and eye problems

half life of maxalt

half life of maxalt

melosteral meloxicam 15 mg

melosteral meloxicam 15 mg

how fast does azathioprine work

how fast does azathioprine work

piroxicam emagrece

piroxicam emagrece

impianto pompa di baclofen

impianto pompa di baclofen

cyproheptadine and sertraline

cyproheptadine and sertraline

lifestyle sports opening hours artane

lifestyle sports opening hours artane

can you get ketorolac tablets

can you get ketorolac tablets

can i order toradol price

can i order toradol price

tizanidine and nursing

tizanidine and nursing

zanaflex addiction symptoms

zanaflex addiction symptoms

periactin pagine sanitarie

periactin pagine sanitarie