On January 8th, Dalian Commodity Exchange opened the market for trading hog futures after the initial announcement early in 2020 and years of planification.

This is China’s first live delivery derivative, and it will provide a hedging tool for participants in the entire pork production industry, although so far, just nine pig producing companies, including Muyuan Foods and New Hope, have received exchange approvals for their facilities to deliver the pigs.

On the opening day, the front-month September contract settled at 28,290 yuan per tonne, a 12.6% lower than the listing price, due to expectations of increasing supplies and falling prices in 2021 following the rapid herd recovery.

Contracts for September fell further to around 24,000 yuan per tonne the following two weeks, but started going up again in the last week of January and February, as news about new ASF outbreaks linked to unknown strains and winter diseases spread.

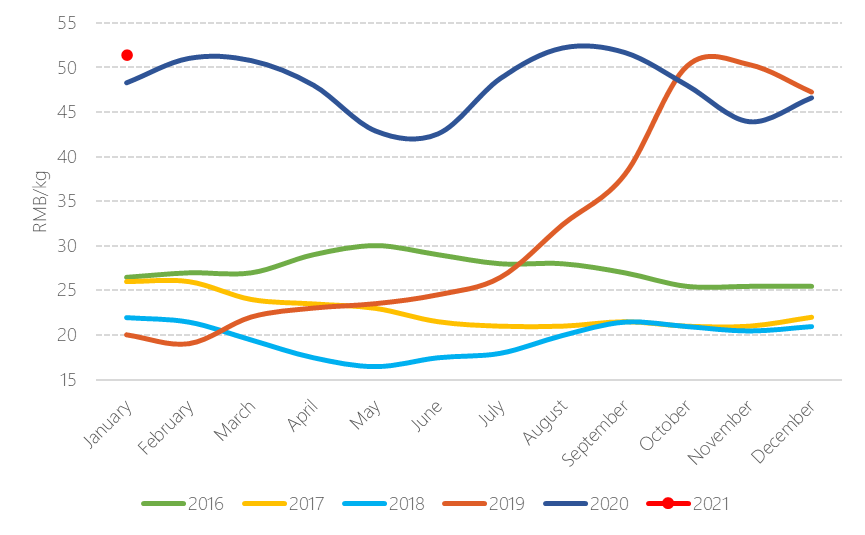

The price for September contracts has been rising ever since, and currently remains at 28,860 RMB per tonne, with prices for November 2021 at 27,870 RMB per tonne, and 28,005 per tone for front-January 2022 contracts, the highest since the opening of the futures[1]. On spot hog prices are currently at 26.35 RMB/kg in Liaoning province and 28.27 on a national average.

These rising prices, over the current on spot prices national average, suggest concerns in the industry that the supply will not expand as much as previously expected, and that hog prices will remain high.

These uncertainties have also reflected on national wholesale prices for pork meat in January (meat from “three-way cross breed”), which increased 6% YoY and 10% from the previous month.

Evolution of pork prices in China (2016-2021)

Source: Eibens with data from China Swine

[1] http://www.dce.com.cn/DCE/Market_Data/Market%20Statistics/index.html