China’s pork production dropped by 0.8% in this third quarter compared to last year. With consumption patterns changing, and being difficult to predict, this decline is not new and has been the trend throughout these months.

The Government is implementing a strategy to rebalance the supply-demand curve by reducing stock, and the strategy seems like is succeeding, with prices going up. Many livestock companies are starting to see bigger profits [1]. The average profit of slaughtered pigs was RMB 412 (53.56 EUR) in October, while the average profit for the first 9 months of the year was RMB 204 (26.52 EUR) [2].

According to the Ministry of Agriculture and Rural Affairs, the price of a live hog was 17.80 RMB (2.32 EUR) in the first week of November. Wholesale prices have been increasing since May with a TOP in Mid-Autum festival. November got back to normal outcomes, but prices are expected to boost again soon due to the arrival of Lunar New Year festivities.

According to the Ministry of Agriculture and Rural Affairs, the price of a live hog was 17.80 RMB (2.32 EUR) in the first week of November. Wholesale prices have been increasing since May with a TOP in Mid-Autum festival. November got back to normal outcomes, but prices are expected to boost again soon due to the arrival of Lunar New Year festivities.

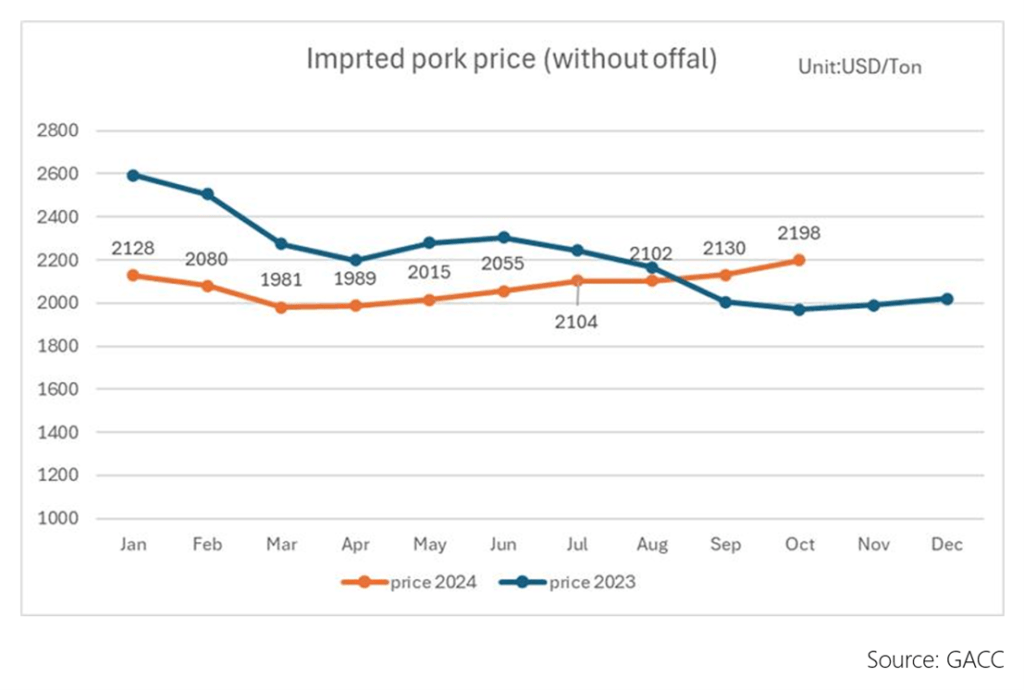

This control in domestic production (to be profitable) is leading to a relative growth in imported pork. The above graph compares CIF prices for imported pork in 2023 vs 2024.

This control in domestic production (to be profitable) is leading to a relative growth in imported pork. The above graph compares CIF prices for imported pork in 2023 vs 2024.

Brazil appears as a strong partner for meat supply. Xi Jinping recently visited the South American country, and two relevant agreements were made: on one side, 11 meatpacking plants were reauthorised to export to China, and 38 were opened [3]. Also, a large pork and chicken private processor acquired processed food factories in Henan, central China. The statement was published during the president’s visit. On the other side, Brazil is very close to finalising protocols of exporting pork offal. Although Brazil is already a major producer and exporter of pork meat, offal remains limited (100,000 metric tons in 2023 to all destinations). For now, Spain is still the major exporter of offal cuts to China.

In the US there may be changes after election day and their new president coming in. One of the promises is that a 60% tariff will be implemented on Chinese commodities [4]. High costs for pigs and accumulated losses from the past months keep pressuring the US livestock sector. For example, two years ago, the average US producers had more than $1,200 (1,136EUR) per sow. Those same producers now have an average of $723 (684 EUR) per sow [5]. USDA reported that for 2024 pork production has decreased by 40 million Kgs. As producers are pressured and with losses, numbers keep going down. For exports to China, this could have an impact soon, as the main barrier for the EU until now to remain competitive was the price.

Even if markets like Brazil are breaking production records, EU markets appear to be in definitive recovery. Supply is increasing and prices are stable, so more competitive. Spanish pigs have reached and maintained a more comfortable scenario that is above the cost price (1.58 EUR/kg end of October). Average carcass weights are again where it was (more than 5kg in five years [6]). Both pig farmers and pork producers are making profit again. Other EU countries’ farms are also growing and selling more pigs, provoking a reduction and stabilization in pork prices [7].

Although the Chinese market is not at its best, Spain maintains its levels from last year for both pork and offal cuts. State regulations and the proximity of holidays mean that imported pork will still be needed. It’s a good moment to benefit from this current positive supply context for EU pork as well as the doubts coming in from America. In the last outlook from the European Commission, production for 2025 is expected to decrease by only 0.2%, a slight reduction that is less than in past years [8]. Total EU pork exports globally are projected to reach 2.87 million tonnes in 2025

[1] https://www.swineweb.com/latest-swine-news/chinas-pork-production-declines-amid-weak-demand-and-shrinking-herd-size/

[2] https://e1.envoke.com/m/4a2dd993ec7995ef7045812b1e80e948/m/76003079622afe5c70c674882aa68aec

[3] https://www.foodmarket.com/News/A/1291167/Brazil-Opens-New-Markets-in-China-and-Increases-Number-of-Authorised-Meatpacking-Plants#:~:text=During%20Chinese%20President%20Xi%20Jinping%27s%20visit%20to%20Brazil,markets%20and%20certifying%20of%2038%20new%20meatpacking%20plants.

[4] https://www.porkbusiness.com/news/ag-policy/trumps-cabinet-nominees-now-odds-expanding-us-trade/economic-war-china?mkt_tok=ODQzLVlHQi03OTMAAAGW7ZFy1PcVDReJzh1i6Nau7YmHABqSYnK6egy1scugf8GpgKz15nrW2_XqdZXZOf0PZMnYqhP-DXM9c3FmZipjT7uHHaaUxWwyXHiHM9PVS8Q-GDLElkU

[5] https://www.porkbusiness.com/news/hog-production/swine-industry-sees-recovery-signs-after-prolonged-downturn?mkt_tok=ODQzLVlHQi03OTMAAAGXAiri4F8EtDFN77RWlWuPM-DTZnLJs7R52-CqyazpAukkO3XHptNT92quOdm_Nw66ZKgeT_OHdkyxGybcT6b3Kn4Rl5pslVtKCZ3W_g2p68NU5GjS_P4

[6] https://www.pig333.com/articles/the-spanish-pig-price-is-at-an-annual-low-for-how-long_20966/

[7] https://www.pig333.com/articles/the-spanish-pig-price-is-at-an-annual-low-for-how-long_20966/

[8] https://www.pigprogress.net/market-trends-analysis-the-industrymarkets/eu-pork-production-stable-in-2025/