The pork industry in China has started rebounding after making losses for a long time. This is seen in the recovering prices led by reduction of pig production capacity, and an increase of slaughter rate. According to the Ministry of Agriculture, the number of sows at the end of April reached 39.86 million, a year-on-year decrease of 6.9%, getting closer to the target of 39 million. The slaughter rate has increased by 2.3% in the first quarter compared to last year.

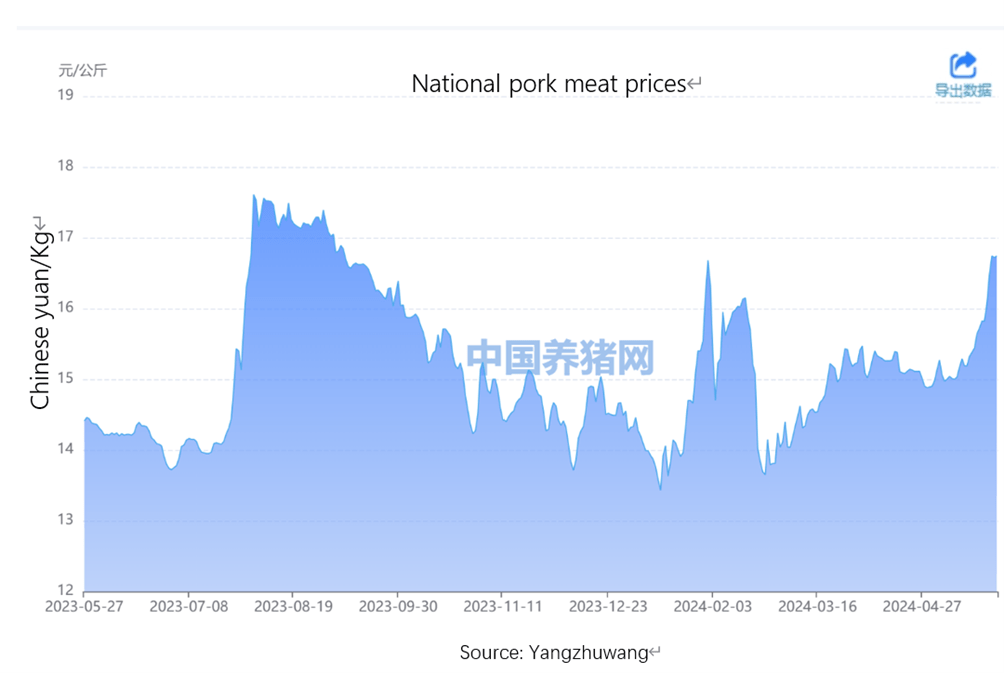

Live pig prices increased in recent weeks. The price of live pigs was 16.74 RMB/Kg (2.18 EUR/Kg) on May 27th, 2024, an increase of 16% compared to last year. Many local companies recently disclosed sales data for April showing a turn from loss to profit such as Muyuan Foods Co., Ltd and Wens Foodstuff Group CO., LTD [1].

The frozen pork inventory level has been dropping to reach its lowest in recent years on the 23rd of May. According to Tongbi Financial, last year’s frozen inventory has been replaced by newly slaughtered meat with an overall lower stock level. The released low-priced frozen meat will have a temporary impact on the market, and further price increase is expected soon [2].

The frozen pork inventory level has been dropping to reach its lowest in recent years on the 23rd of May. According to Tongbi Financial, last year’s frozen inventory has been replaced by newly slaughtered meat with an overall lower stock level. The released low-priced frozen meat will have a temporary impact on the market, and further price increase is expected soon [2].

As officially announced by The Ministry of Commerce of The People’s Republic of China [3], Chinese companies are allowed to request an anti-dumping investigation into related pork and other pork by-products originating in the European Union. Further updates on this matter are awaited. From the beginning of 2024, China has expanded the range of pork products, especially offal: Jan-Apr total offal import volume increased 3.8% YoY. These newly acquired market-access products come from countries such as Belgium (whose ban has been lifted, after six years), The Netherlands, Austria and France.

[1] 猪价企稳回升 养殖企业盈利能力修复_央广网 (cnr.cn)

[2] 冻品库存降至近年最低,“缺猪不缺肉”现象缓解__财经头条 (sina.com.cn)

[3] Announcement of the Ministry of Commerce [2024] No. 23 on the anti-dumping investigation of import-related pork and pig by-products originating in the European Union (mofcom.gov.cn)