For decades, many rural Chinese households raised backyard pigs, considered valuable livestock as a source of not only meat but also manure. Pigs also hold cultural significance as a symbol of prosperity because, historically, pork was served only on special occasions.

Today, no country eats more pork than China, which consumes half the world’s pig meat. Pork prices are closely watched as a measure of inflation and carefully managed through the country’s strategic pork reserve, a government meat stock that can stabilize prices when supplies run low.

Regardless of an upward revision for China pork production in 2023, domestic supplies are unlikely to fully meet rebounding consumption, this is why to secure as much supply as possible, the Chinese government is taking a shot into a new way to raise pigs: high-rise hog farms.

Huge edifications that are highly automated and introduce new technologies to farming with monitored pigs and uniformed technicians. Different floor hosts different stage of a young pig’s life: pregnancy, farrowing, nursing, and fattening. The feeding process is carefully supplied by a conveyor belt according to the pig’s weight and health status, even pig manure is measured, collected, and repurposed.

These buildings have sprung up nationwide as part of Beijing’s drive to enhance its agricultural competitiveness, and as amazing as this might sound, this project is becoming a reality in different provinces. This is new pig farming in China, where agricultural land is scarce, food production is lagging, and pork supply is a strategic imperative. Until 2019, such pig farms were illegal in China, but following ASF outbreaks, the Chinese government lifted the ban, trying to increase production and giving some clues about their upcoming needs.

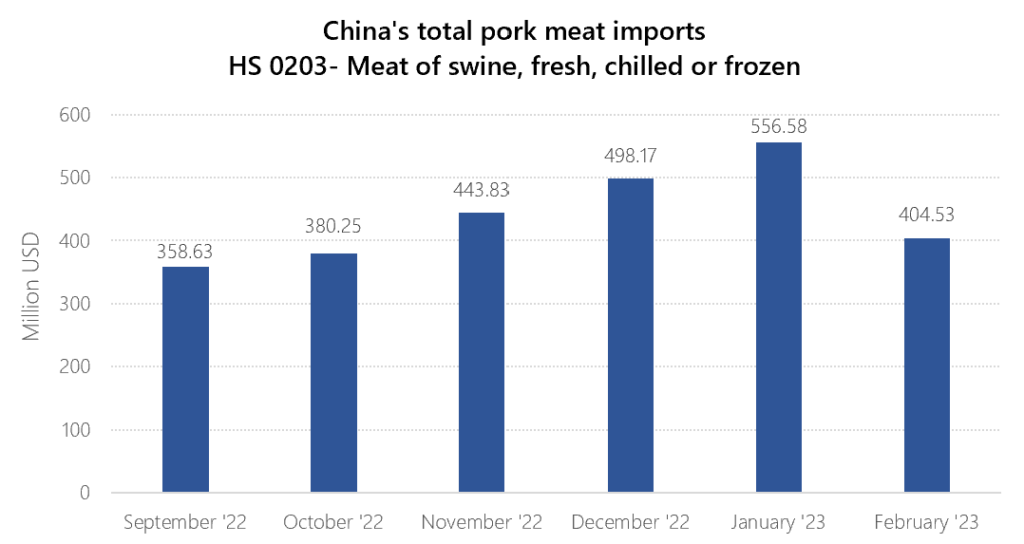

In return, China’s pork industry this year is showing great efforts to recover, according to the United States Department of Agriculture (USDA). Either way, the upward revisions for China pork meat import forecasts are partially derived from higher estimates for 2022 as fourth quarter shipments were stronger than expected. For 2023, projected economic recovery as well as the anticipated revival of the hotel, restaurant, and tourism sectors support expanding consumption and imports.

December 28, 2022, marked the end of a group of highly restrictive measures in China when the General Administration of Customs (GACC) published the announcement No. 131, changing COVID-19 controls and management, ending PRC-required testing and disinfection measures on imported cold-chain foods and non-cold chain goods effective from January 8, 2023, bringing a much-needed relief for exporters and consumers alike and providing a new panorama for the year to come.

Even though there was a degree of caution from Chinese consumers in the first months of the year given uncertainties over jobs and incomes, it is expected that growth will resume in the second quarter after the worst waves of infection have receded.